Invest in a Proven Multifamily Operator With $2.5B+ Acquired Assets

RISE48 — Multifamily Investment Opportunity

Join thousands of investors who trust RISE48 for recession-resilient, tax-advantaged apartment investments with strong cash flow and appreciation upside.

15%–20% Average Annual Return

6%–10% Cash Flow (Preferred Return by Class)

2.0x+ Equity Multiple Potential

WHY INVEST WITH RISE48?

RISE48 handles everything — acquisitions, renovations, management, and distributions.

A Vertically Integrated Multifamily Platform

RISE48 controls acquisitions, construction, asset management, and property management — providing investors with unmatched oversight and operational efficiency.

300+ full-time staff across operations

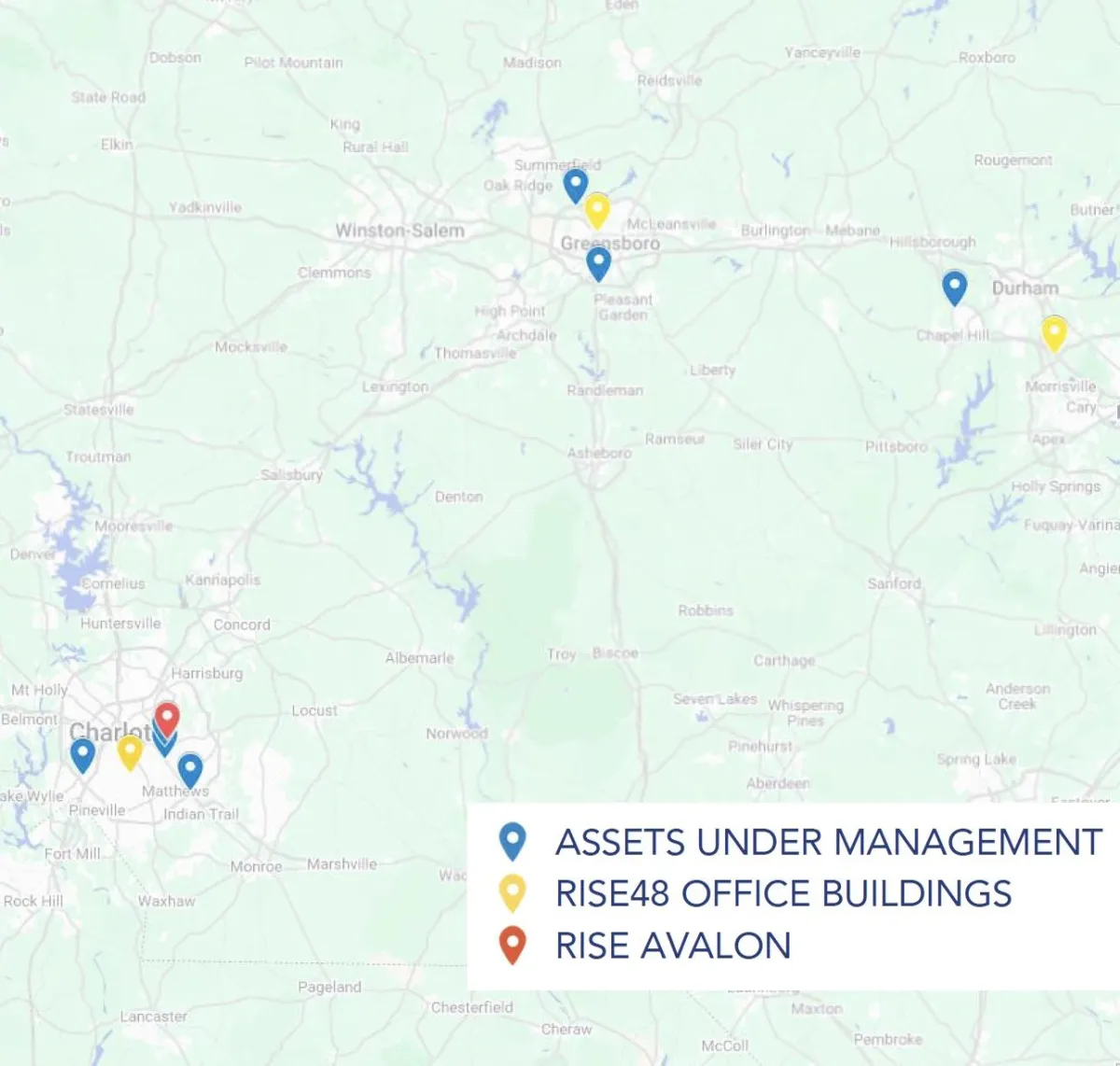

Local teams in Arizona, Texas & North Carolina

35+ full-time employees in NC alone

This structure gives us total control over execution and eliminates third-party inefficiencies that reduce investor returns.

OUR TRACK RECORD SPEAKS FOR ITSELF

11,506 Units | 61 Properties | $2.5B+ Acquired

Across stabilized and value-add acquisitions, our track record continues to outperform underwriting.

Recent Portfolio Performance:

Across 1,159 units sold, RISE48 achieved:

70.5% average IRR vs. 15.4% projected

2.11x equity multiple on average

Average hold period of just 17.7 months

This demonstrates our ability to create value quickly and return capital faster.

CURRENT OFFERING: RISE AVALON – CHARLOTTE, NC

A 240-unit, B+ class community with major value-add upside

What Makes This Deal Exceptional?

Purchased at 30%+ below peak pricing

Significant value-add upside: Renovate 100% of units + add washers/dryers

Tax abatement strategy eliminating up to 90% of property taxes

Extremely low basis: $170K per unit

94% current occupancy

Located in high-growth East Charlotte submarket

Projected Outcome

A conservative underwriting model that delivers:

6%–10% preferred cash flow

2.0x equity multiple (Class B)

15.9% IRR (Class B projection)

22% projected AAR for Class C

WHY CHARLOTTE?

Charlotte is one of the fastest-growing metros in the U.S., home to major employers including:

Bank of America (16,000+ employees)

Wells Fargo East Coast HQ (27,000+)

Coca-Cola Consolidated (16,000+)

The city continues to experience:

A conservative underwriting model that delivers:

Strong in-migration

Housing supply shortages

Above-average rent growth

A stable employer base

This makes Charlotte an ideal market for cash-flowing, recession-resilient multifamily investments.

HOW WE CREATE VALUE

Full Renovation Plan

Our construction team upgrades classic units to Rise48 Diamond Renovation Level, including:

New vinyl plank flooring

2-tone paint

Resurfaced countertops & tubs

Stainless steel appliances

Shaker cabinet doors

In-unit washer/dryer additions

This increases rent, resident quality, and long-term property value.

Conservative Underwriting

Interest rate capped at 4.75%

$1.9M in cash reserves

Deal breaks even at ~65% occupancy by Year 5

Zero impact from rising Fed rates due to rate cap strategy

Passive Income

Depending on the class:

Class A: 10% preferred return, no upside

Class B: 7% preferred return + upside participation

Appreciation & Growth

Value-add renovations + operational efficiencies increase NOI, resulting in higher property value.

Tax Advantages

Investors receive:

2025 depreciation benefits

Potential bonus depreciation

Shelter against W-2 income (depending on tax status)*

Ready to Take the Next Steps?

Investment managed by an experienced team of proven industry veterans